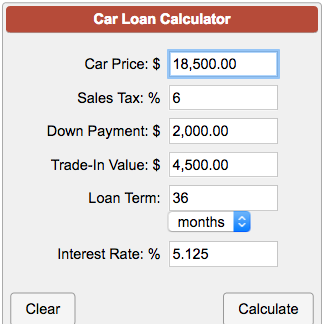

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. Borrowers falling under the deep subprime category, between 300 and 500, can expect rates over 14 percent for new and over 21 percent for used, according to Experian’s first quarter of 2023. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario. their new car quicker with a car loan sourced via our national Stratton Finance. Keep in mind that everyone's situation will be different, so these recommendations are not set in stone. Use the Stratton Finance Car Loan Calculator to calculate your car loan. Used car (dealer): Example: A 5-year, fixed-rate used car loan for 25,000 would have 60 monthly payments of 487 each, at an annual percentage rate (APR) of 6.29. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance. New car (dealer): Example: A 5-year, fixed-rate new car loan for 37,000 would have 60 monthly payments of 717 each, at an annual percentage rate (APR) of 6.09. Your loan payment should be no more than 15% of your take-home pay. New Auto Loan Purchase Price Down Payment Term of Loan Interest Rate Trade-In Value Amount Owed on Trade Calculate 601 a month Estimated payment (for 36 months at 5.19 APR) Purchase Price 20,000.00 Down Payment 0.00 Trade-In Value -0.00 Amount Owed on Trade +0. The general rule for each of these is as follows: It is also important to be aware of how much the loan will total, how much of a down payment you're making, and how long the loan will be. And though this figure is the easiest to understand, it isn't the only number to be aware of. It can give you a reality check on whether you can afford the vehicle. Time for a new ride, or just looking Estimate your monthly payment by entering your loan amount, Annual Percentage Rate (APR), and loan term length. Personal lines insurance.The monthly payment is the best indicator of how the car loan will impact your budget. Vehicles with branded (flooded, salvaged or reconstructed) title or motorcycles, boats andĤ Cash out is not available on vehicle purchase transactions.ĥ Financing is not allowed on vehicles older than 10 years or those with mileageĮxcess of 150,000 at time of origination.Ħ SECU Insurance Services has partnered with AAA Insurance to provide auto and

#New car loan calculator free

Lending is limited to residents of North Carolina, South Carolina, Georgia, Tennessee and Virginia.ģ Vehicle title held as collateral until the loan is repaid. Free and easy-to-use automated calculator which quickly estimates your monthly car loan payments & helps you figure out how expensive of a car you can. If you qualify, we can give you a quote for the current rate and most loan documents can be signed electronically.Ģ Members must be at least 18 years of age or otherwise eligible for lending services to apply. That’s compared with 38,948 in December 2019, before the. While auto equity loans aren’t very common, they allow you to borrow against the equity you have in your car. Use the auto loan refinance calculator to find potential savings.

Your actual APR will be determined at the time of disbursement and may vary based on credit score, collateral, and loan terms. As recently as December 2022, the average transaction price for a new car peaked at 49,507, according to data company Cox Automotive.

Rates are subject to change prior to the completion of the loan. This lets you see right away how much you can borrow from ABN AMRO and what your. approved whether youre buying new or used, privately or from a dealer. Mortgage insurance: The mandatory insurance to protect your lenders investment of 80 or more of. The Westpac Car Loan calculator lets you estimate repayments on a secured loan. The traditional monthly mortgage payment calculation includes: Principal: The amount of money you borrowed. Also calculates total payments and total interest paid on your auto loan. Principal + Interest + Mortgage Insurance (if applicable) + Escrow (if applicable) Total monthly payment. APR is your cost over the loan term expressed as a rate. You can calculate what your loan will cost using our loan calculator. Use this calculator to find how much your monthly car payments will be.

0 kommentar(er)

0 kommentar(er)